Employee Loans Ifrs 9

Accordingly after initial recognition they are recorded at amortised cost using the effective interest rate eir.

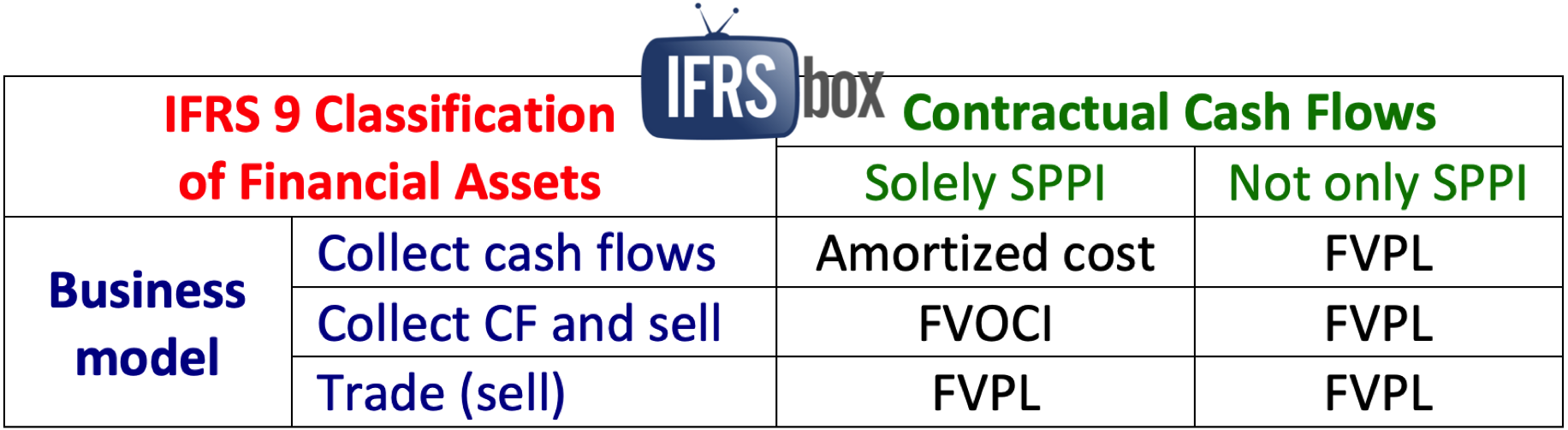

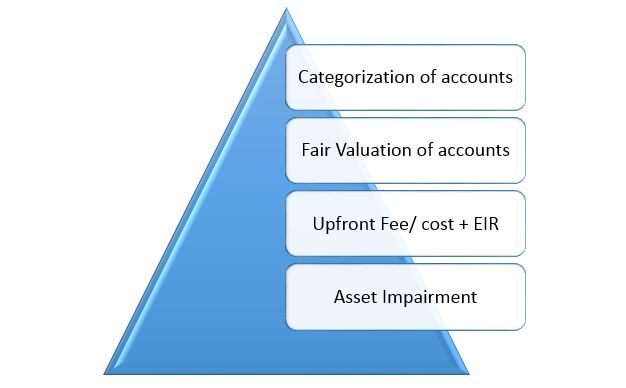

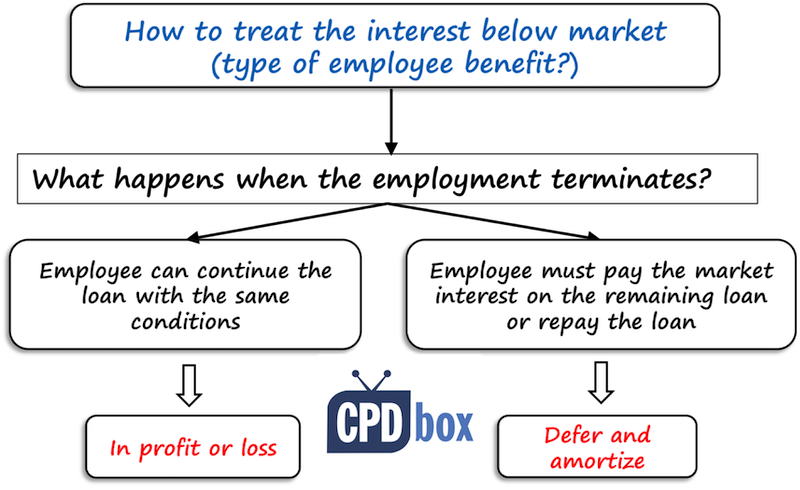

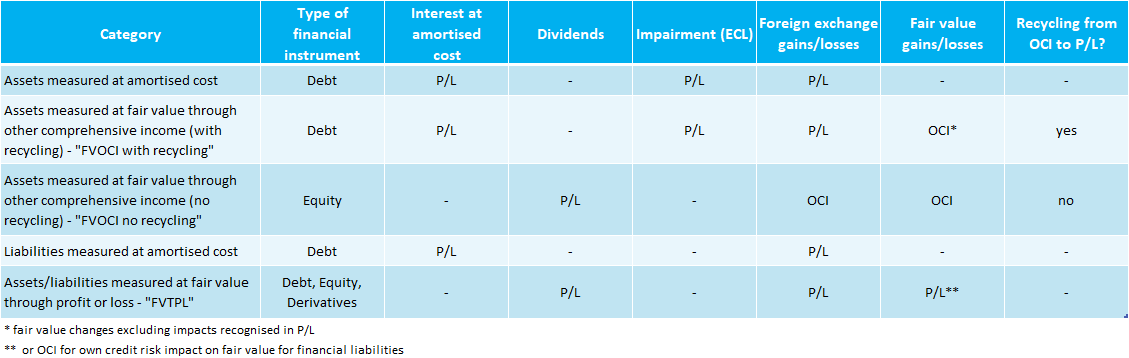

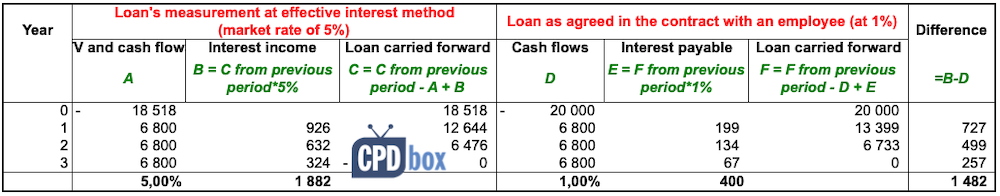

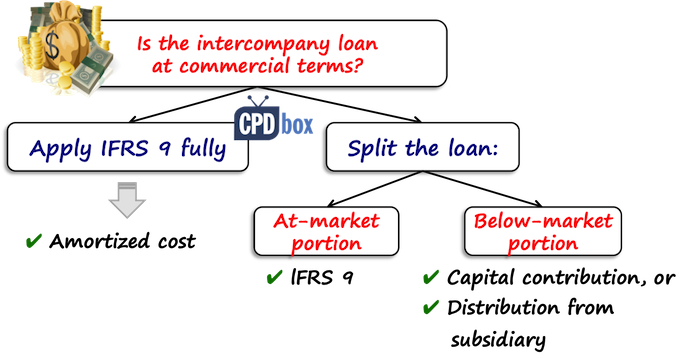

Employee loans ifrs 9. Paragraph 5520 of ifrs 9 describes the financial instruments that fall within its scope and paragraph b5539 of ifrs 9 sets out three characteristics a c that are generally associated with such financial instruments. Key considerations in assessing these general characteristics as well as the overall principle and relevant disclosure. If the loan would have been made on market terms then clearly its fair value at inception would have equaled the loan amount of cu 20 000. Ifrs 9 describes requirements for subsequent measurement and accounting treatment for each category of financial instruments.

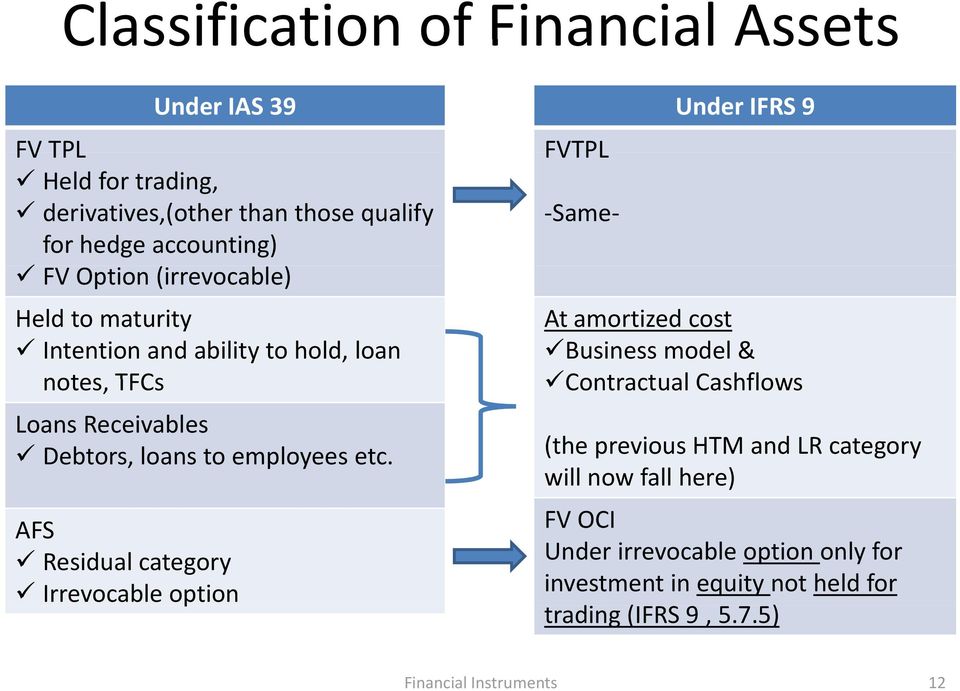

Assets measured at fvtpl are not subject to impairment requirements of ifrs 9 ifrs 9551. Ias 39 outlines the requirements for the recognition and measurement of financial assets financial liabilities and some contracts to buy or sell non financial items. How to account for employee loans below market interest rate. 3353113 and is registered as an overseas company in england and wales reg no.

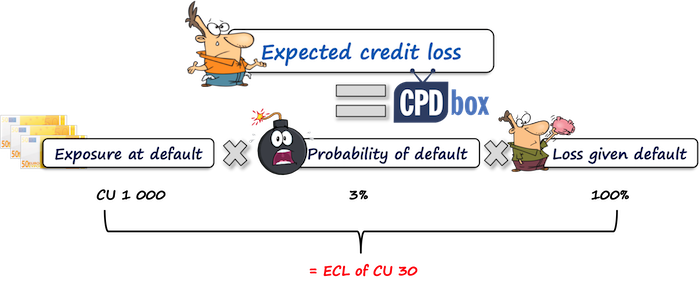

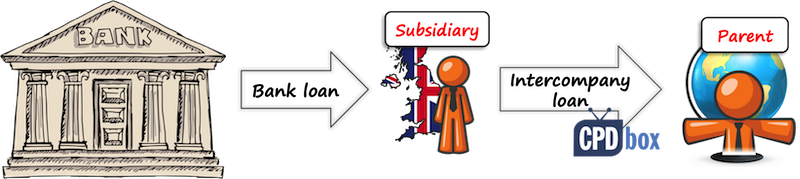

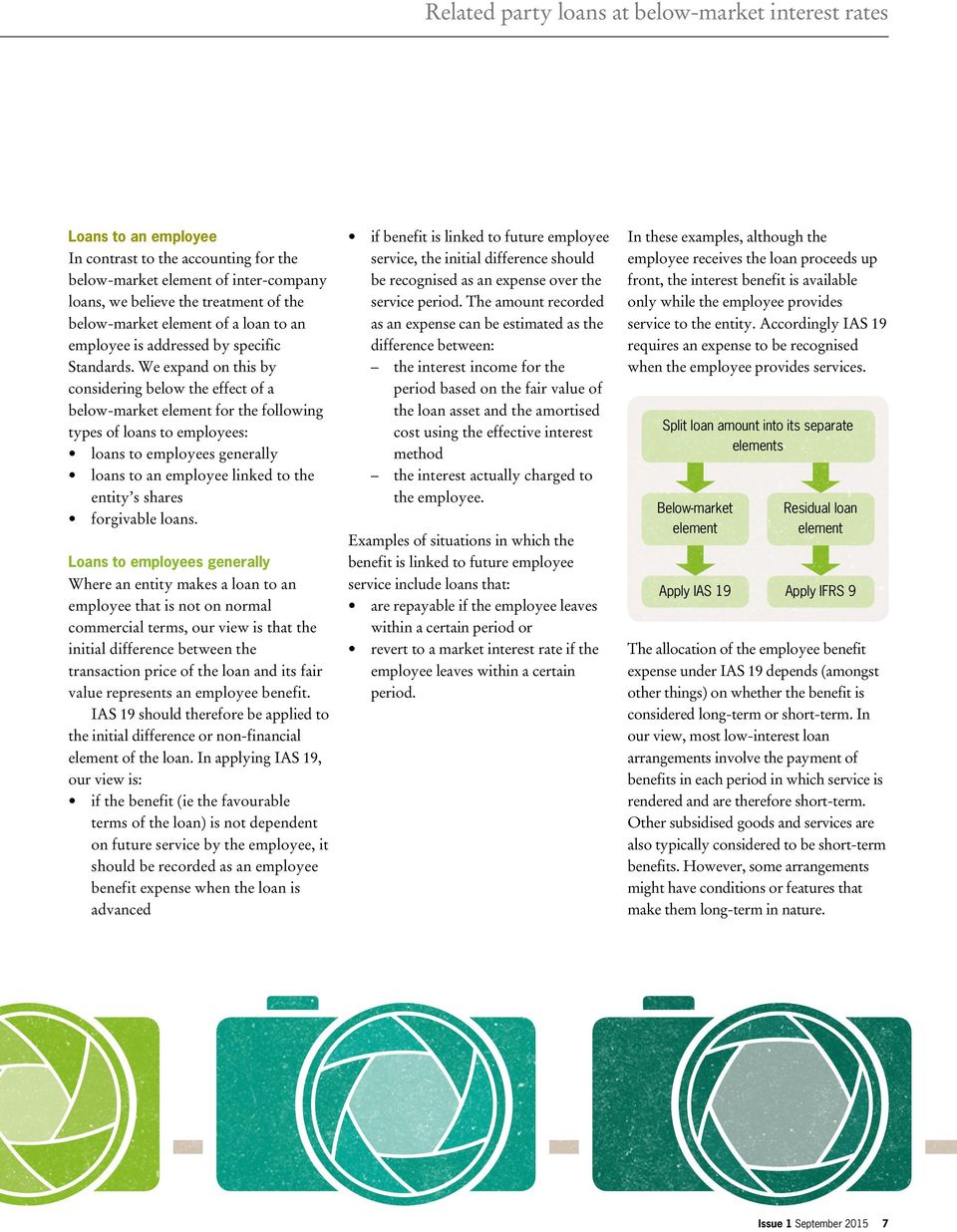

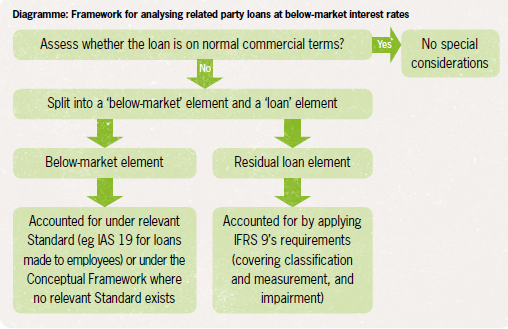

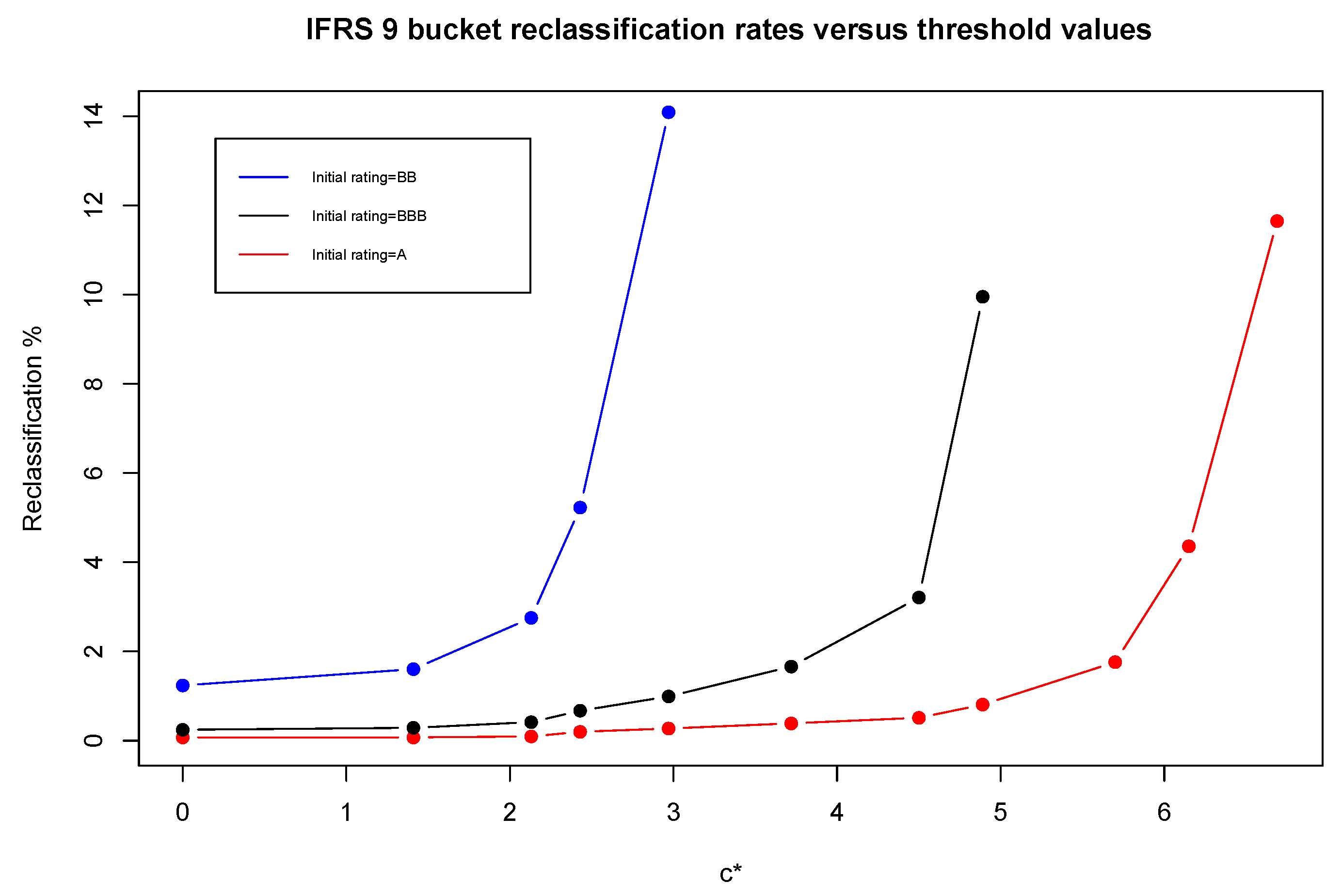

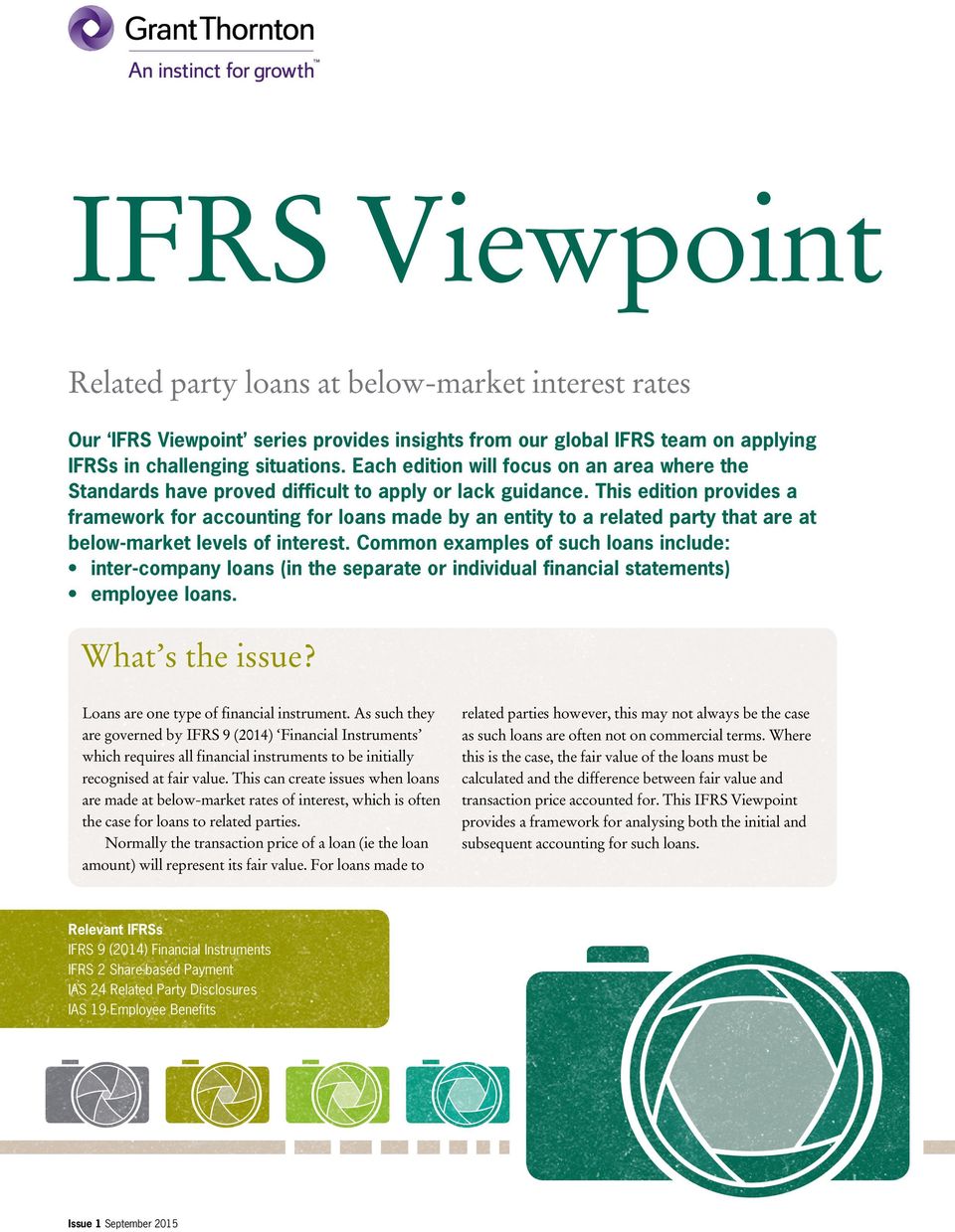

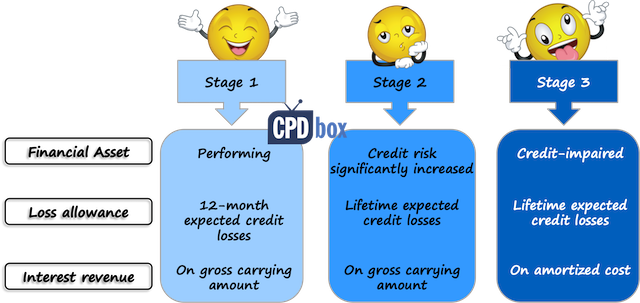

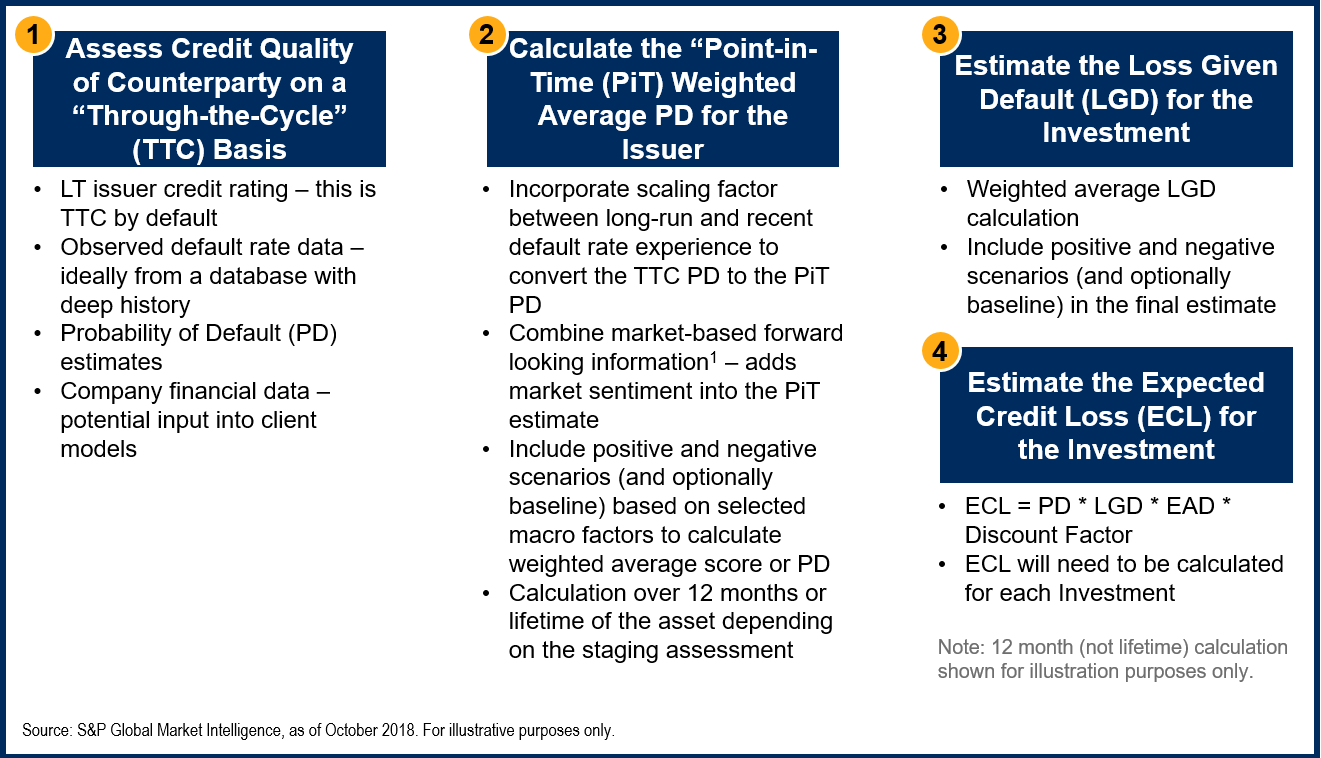

Ifrs 9 expected credit loss making sense of the transition impact 5 5 total overage ratio. Classifies the loan at amortized cost under ifrs 9 or into loans and receivables category under ias 39. Related party loans at below market interest rates ifrs viewpoint global accounting tax relevant ifrs ifrs 9 2014 financial instruments ifrs 2 share based payment ias 24 related party disclosures ias 19 employee benefits our ifrs viewpoint series provides insights from our global ifrs team on applying ifrss in challenging situations. The numerators are respectively the ias 39 total loan loss allowance and the ifrs 9 total ecl allowance and the denominators are gross loan balances excluding cash securities and off balance sheet exposures.

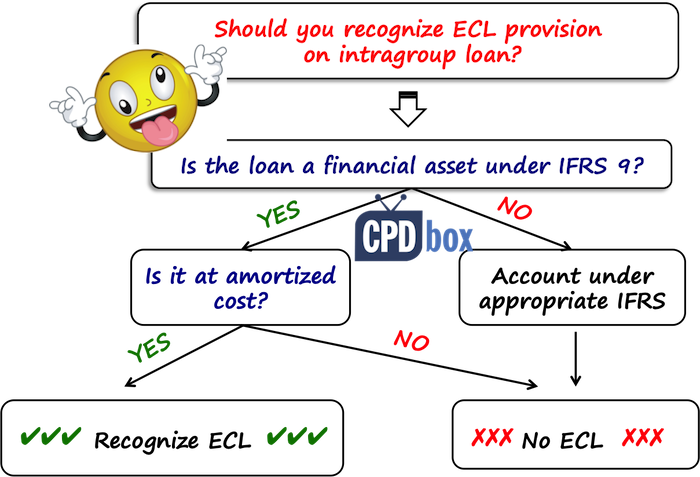

But this is not the case. Employee loans are usually included in ias 39s loans and receivables category ifrs 9s amortised cost measurement category. The loan asset is also subject to ias 39s impairment requirements. Ifrs 9 here you will find step by step process of determining the default rates and calculating the provision under ifrs 9.

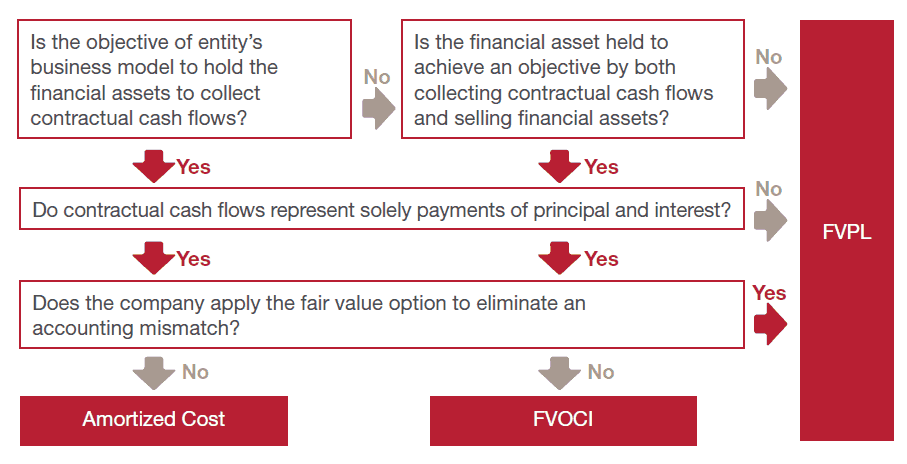

Financial assets that are debt instruments measured at fair value through other comprehensive income loan commitments that are not measured at fair value through profit or loss under ifrs 9. Financial instruments are initially recognised when an entity becomes a party to the contractual provisions of the instrument and are classified into various categories depending upon the type of instrument which then. Financial assets that are measured at amortized cost. Accounts receivable loans debt securities bank balances and deposits etc.

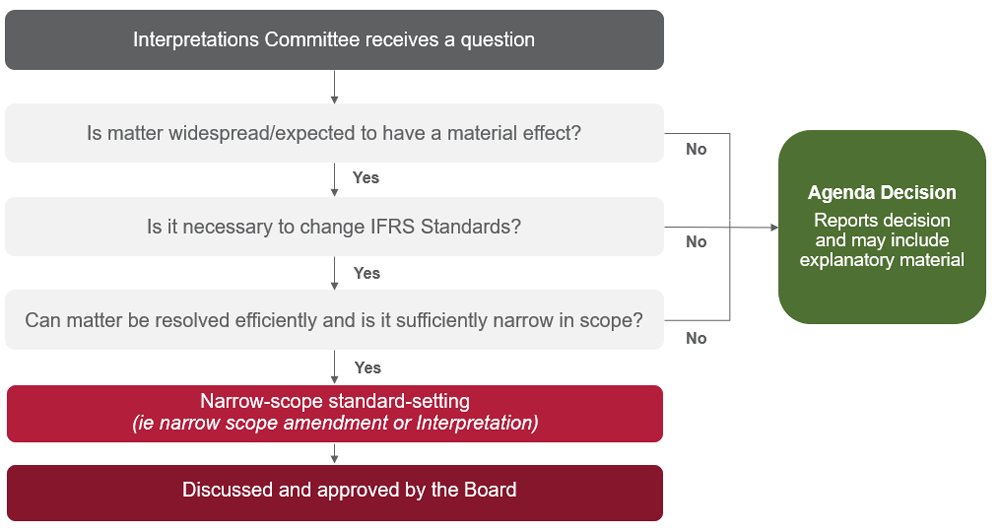

The international financial reporting standards foundation is a not for profit corporation incorporated in the state of delaware united states of america with the delaware division of companies file no.

.jpg)